| | Driving Without a Seatbelt |

Protect your customers and

yourself by offering uninsured/underinsured motorist coverage. As many as 13% of all U.S.

drivers are uninsured, according to the Insurance Research Council. That

percentage varies state by state, with the highest percentage of uninsured

drivers found in Florida where 26% of driver are uninsured.

Often, it is the worst drivers who are uninsured because their driving

record pushes their premiums to levels they cannot afford. Uninsured

drivers put the livelihood and financial stability of law-abiding citizens

at risk. The solution is uninsured motorist coverage.

All states but New Hampshire have a minimum required amount of coverage a

driver must carry to legally operate an automobile. However, these minimum

limits have not kept pace with the rising cost of inflation.

Florida, for instance, only requires $10,000 of coverage for property

damage and $10,000 of coverage for personal injury. Meanwhile, California

requires $15,000 in coverage for personal injury and only $5,000 for

property damage. These state-mandated limits are not nearly enough to cover

a serious auto accident.

Roughly, 40% of states allow drivers to stack uninsured/underinsured

motorist coverages. In those states, a policyholder can multiply their

UM/UIM coverage by the number of autos they insure, which is an important

feature of the auto policy in states that allow stacking. However, except

in Rhode Island, insurance carriers are allowed to prohibit stacking

policies and agents need to make sure they are offering a stackable policy

if the state allows.

Another twist is uninsured motorist property Damage (UMPD), which is

available in 15 states. An additional eight states require it. Traditional

UM/UIM coverage includes medical bills, pain and suffering, and lost income

damages to a driver and their family members in their auto or another auto,

as well as passengers in the covered auto. UM/UIM coverage does not cover

damage to your auto. UMPD coverage will pay for uninsured or underinsured

property damage resulting from an accident.

While many see UMPD as a duplication of collision coverage, it is much

cheaper than collision coverage and usually carries a lower deductible.

UMPD is an excellent alternative for older or lower value autos, especially

if the customer wants to drop their collision coverage.

Agents should always offer limits that match the liability limits of the

customer. In fact, some states require a customer to sign a rejection form

if they choose less coverage than the liability limits they carry.

Moreover, don't forget the umbrella coverage. Make sure to offer matching

UM/UIM limits on any umbrella policies you place.

UM/UIM limits will never be an errors and omissions issue until you have a

customer who is badly injured in an auto accident. That is why it's best to

make sure you document that you offered the coverage and note any higher

limits that are rejected by the customer to protect your agency from an

E&O claim.

*******************

James Redeker is vice president

and claims manager at Swiss Re Corporate Solutions and works out of the

office in Kansas City, Missouri. Insurance products are underwritten by

Westport Insurance Corporation, Kansas City, Missouri, a member of Swiss Re

Corporate Solutions.

This article is intended to be used for general informational

purposes only and is not to be relied upon or used for any particular

purpose. Swiss Re shall not be held responsible in any way for, and

specifically disclaims any liability arising out of or in any way connected

to, reliance on or use of any of the information contained or referenced in

this article. The information contained or referenced in this article is

not intended to constitute and should not be considered legal, accounting

or professional advice, nor shall it serve as a substitute for the

recipient obtaining such advice. The views expressed in this article do not

necessarily represent the views of the Swiss Re Group ("Swiss

Re") and/or its subsidiaries and/or management and/or shareholders.

Copyright © 2018, Big "I" Advantage, Inc. and Westport Insurance

Corporation. All rights reserved. No part of this material may be used or

reproduced in any manner without the prior written permission from Big

"I" Advantage. For permission or further information, contact

Agency E&O Risk Manager, 127 South Peyton Street, Alexandria, VA 22314

or email at eo@iiaba.net.

| |

|

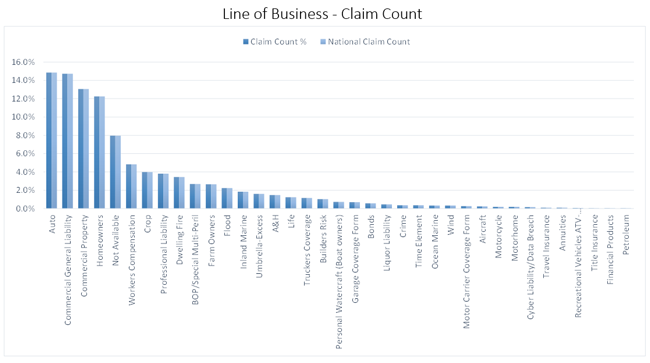

Almost 15% of the total claim

count comes from Personal Auto coverage claims.

(Enlarge Chart)

Source: Advance Claims - Swiss Re Corporate Solutions Claims

Data source

|

|

Live Webinar: AgencyRisk

Management Essentials Free Risk Management Webinar: Join

our Free January Agency Risk Management Webinar:"Let's Talk

Limits" Everyone knows the story of

Goldilocks, and her struggle to find the porridge, the chair, and the bed

that was "just right." When it comes to limits of liability, it's

often said that the highest limit is best but in practice, agents must help

their clients settle on the amount that is "just right" for the

situation at hand. How can you ensure your approach to

limits is correct? Do you feel confident that proper policy limits are in

place for your clients? Do you worry about whether your own agency is appropriately

protected? When your customers are under-insured, it creates claims against

your agency. When your agency is under-insured, it limits the defense your

carrier can provide. Don't let the fear of a large claim

keep you up at night. Take action by joining Big "I" Professional

Liability and Swiss Re Corporate Solutions for an Agency Risk Management

Essentials webinar: Topic: Let's Talk Limits: How Much Is Enough for You AND Your

Customer? Date: Wednesday, Jan. 22nd, 2020 at

2 p.m. ET. REGISTER TODAY! For more risk management

information and resources, including past webinar recordings from this

series, visit the www.independentagent.com/EOHappens. During the hour-long webinar, Swiss

Re Corporate Solutions panelists Matt Davis, claims manager and Mark

Shackelford, senior underwriter, will discuss how to approach choosing liability

limits for both your clients and your own agency. The webinar will feature

scenarios for you take into consideration and provide lessons learned from

a claims and underwriting perspective. This webinar series is offered by

Big "I" Professional Liability at no cost as an exclusive Big

"I" member benefit. Big "I" members in good standing

may register unlimited attendees from the member agency to attend. No CE is

received for this session. If you have any

questions please contact Pam Andrews. Big "I" Professional Liability offers these free

quarterly risk management webinars as an exclusive Big "I" member

benefit. A collection of risk management resources, including articles,

checklists and webinar recordings, is available on the E&O Happens website. Log

in with your Big "I" username and password to check it out. |

|

| | You have

received the E&O

Claims Advisor newsletter because you are a member the Big

"I" Professional Liability Program. The E&O Claims

Advisor is a monthly electronic newsletter designed to provide you

with information concerning products, services and guidance available

to you through the program. IIABA, your professional association, along

with its subsidiaries, including Big "I" Advantage, Inc.,

works hard to bring information to you about valuable products and

services that could enhance your ability to succeed in the industry's

competitive environment. If you do not wish to receive E&O Claims Advisor,

click the link below to unsubscribe. |

| Click here to

unsubscribe.

|

| |

|

|